November 2017

Vision and Planning

Financial Visioning in Seven Steps

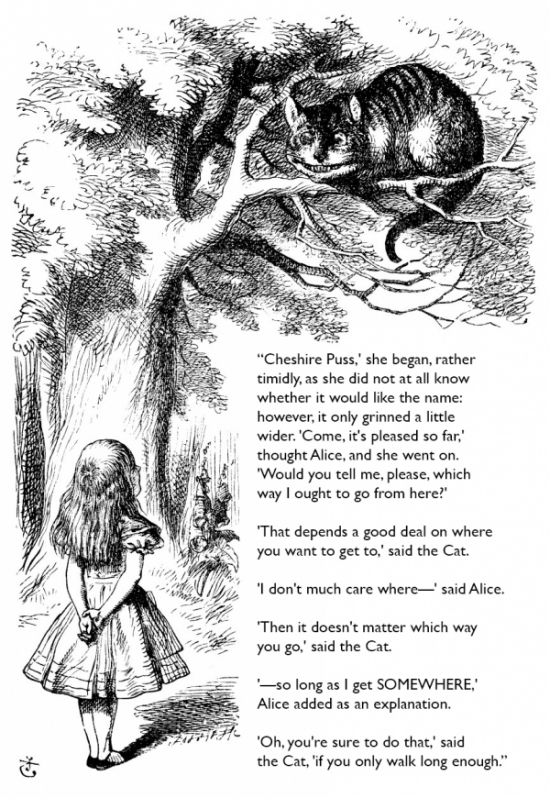

Visioning is defined as “the development of a plan, goal, or vision for the future.” In this excerpt from Lewis Carroll’s Alice in Wonderland, Alice does not have any vision at all. Alice is going with the flow, doing things the way they have always been done, not rocking the boat, and biding her time on the vestry. By definition, a vision identifies a desired state, usually followed by a goal that is reached. Without a vision of where the congregation wants to be, how will it know when it arrives? If a person cannot imagine success in their mind, how do they ever expect to achieve it?

Visioning is hard, at least to carry the vision through to reality. It takes a leader to have a vision and inspire others to make it their own, too. Too often good visions are not realized for lack of taking the steps necessary to achieve the vision. The vision seems too ambitious, too far into the future, or requires too many resources. Such attitudes will assure the vision will not be achieved.

What is required of the process of visioning is to break the vision down into manageable parts that define the vision, mission, goals, tasks, and activities necessary to execute on a daily basis to move toward the vision. Some might call this the difference between having a strategy and the process of strategic planning.

Congregations often see the future as, “how are we going to end the year with this year’s budget”, or only as far as the plan for next year’s budget. Often, there is no plan in the budget, or money set aside, for future events. Some of those events can be foreseen. For example, the carpet is looking worn, the hymnals or prayer books are losing pages, or the paint is peeling on the exterior of the building. Other events are big surprises, such as the air conditioning needing replacing after failing on Good Friday, or the sudden leak in the sanctuary’s roof. To keep the operations of the church going while planning for the future requires a different perspective on future financial matters than most vestries pursue. It is not about the annual fiscal budget solely. There must be a plan for a number of events, some near-term and some in future years.

Financial Strategic Planning

Step 1: Gather data

An assessment must be made of the state of the congregation. What are the demographics of the members and visitors? How has that changed in the last ten years? What is the prognosis for what the demographics will be in the next ten years? And, what does that mean for the future income potential? Using the Episcopal Church’s “Study Your Neighborhood” website, select “explore your neighborhood.” Most congregations do not know about this wonderful service that will give both historical and future demographic information about the congregation’s market circle, including households, income, age, ethnicity, and more.

Step 2: Analyze data

An assessment must be made regarding the donors. If the congregation is running ACS Technologies software, a ten-year analysis of individual and total giving can be readily produced. The objective is to learn about the giving trends. What are the congregation’s experiences of giving from their donors (amounts and purposes)? Pledge donations are generally for operating purposes, while designated gifts are, too, but for specific purposes. Attention needs to be paid not only to the trend (increasing or decreasing) but also to the ratio of designated giving to total giving. If that ratio is on the rise, I get concerned about the commitment of the members to the congregation’s general direction pastorally. A shift away from pledges towards other giving might indicate a problem. This could mean the members do not feel a part of the Body of Christ, but are becoming siloed in their own personal interests or disillusioned with the general vision and mission of the congregation.

Step 3: Take stock of the current status

An assessment of the physical facility must be made. It would be wonderful if there were a fixed asset schedule that listed when the carpet was installed, when the roof was put on, or when the air conditioning system was installed. In addition, a fixed asset schedule would list the estimated useful life, acquisition cost at the time, and estimated remaining useful life. Having one gives future vestries insight regarding when things might need replacing and the ability to proactively plan for them. But the vast majority of parishes do not maintain one. However, the need for understanding this information in order to properly identify future financial requirements beyond operating expenses is very important. An effort must be made to ascertain when some of these components were installed, when they might need replacing, and what the replacement cost would be today. A spreadsheet is helpful to forecast the replacement year, and the estimated future cost.

Step 4: Develop a plan

Develop two budgets – one for operating and one for capital needs. Most congregations are not prepared for an emergency like an air conditioner malfunction. Many are fiscally hurt by such a large, sudden expenditure. The operating budget needs to consider the income and expense expectations for the operation of the church for the year. The capital budget needs to establish projected replacement items, time frames, and costs. While the planning horizon for the operating budget is a year or two, the capital budget planning horizon needs to be sufficient to encompass major components, such as painting, carpeting, roof, plumbing, electrical, air conditioning/heating systems (HVAC), parking lot resurfacing, refurbishing the organ, etc. A twenty-year horizon is the minimum to use for capital budgeting planning.

A year-by-year schedule needs to be developed with the expected capital expenditures per year. This gives a cash requirement by year for future years from which to plan the reserves that need to be set aside and accumulated each year in preparation for the capital event.

Fold the capital cash requirements back into the annual fiscal budget to begin to accumulate the planned repair or replacement of items. This blending of the capital budget with the annual operating budget will yield a new required cash income to support both the capital and the operating budgets for the year. Often, this is an eye-opening experience and generates a lot of capital campaigns to establish or catch up with the cash reserve needs that likely have not been set aside to date.

Step 5: Assess the feasibility of the plan

Refer to the previously mentioned donor analysis and determine if the trend will support the new budget. Often, it appears as though the capital budget cannot be supported by the current giving levels. But it has to. Failure to provide for future large expenditures for the sake of current gratification of programs or salaries is fiscally not sound, detrimental to future vestries, and risks the future financial stability of the congregation.

Step 6: The Make vs. Buy decision

Do we have the expertise, broad consensus, institutional drive, and manpower to execute the plan in the congregation? I suggest the congregation considers hiring a company that specializes in developing and running stewardship and capital campaigns. They are likely going to conduct a feasibility study initially to determine the appetite of the donors which usually means interviewing specific donors. A reputable company will not recommend a capital campaign that does not have a likelihood of success. They have a reputation to maintain and only want successful campaigns, as you do. They will suggest timing, amounts, messaging, dates, events, and other integral parts of a successful campaign based on their experiences with success. If not hired, the congregation will need to conduct these activities regardless in order to be more successful.

Step 7: Execute the plan

Good planning can go awry in the execution of the plan for a myriad of reasons. Lack of appropriate, clear, and consistent messaging is one of the main reasons for failure. Follow-through, monitoring, and honest in-progress assessments and adjustments can either add to successful execution, or failure to do those things will detract from the successful execution. With good planning and execution, the congregation stands a better chance of achieving the vision.

In summary, having a future vision is a good thing. It entails a strategy that shows hope for the future. Realizing that vision is quite another thing. It takes strategic planning to bring it to fruition. Whether it is this example of budgeting or some other long-range vision, the fruits are in the process of strategic planning and execution thereof that make the difference between a dream and reality.

James B. Jordan CPA, CFE

Mr. Jordan is a Certified Public Accountant and Certified Fraud Examiner. His consulting and auditing practice is dedicated to serving only churches and their higher denominational organizations. He is the author of Financial Management for Episcopal Parishes, Revised Edition, 2017, Church Publishing, Inc., New York. He earned his Executive Masters of Business Administration from Emory University’s Goizueta Business School, with international business emphasis from London Business School. His speaking engagements span the globe to six continents and dozens of countries. He has conducted live webinars and on-line learning courses for Masters of Divinity credit. Mr. Jordan is an adjunct professor at Emory University’s Candler School of Theology, Atlanta, Church Divinity School of the Pacific, Berkeley, CA, and General Theological Seminary, New York City. He and his wife, Eileen, are members of St. Paul’s Episcopal Church in Newnan, Georgia. Mr. Jordan is a member of the American Institute of Certified Public Accountants (AICPA), the AICPA Not-for-Profit Section, and the Association of Certified Fraud Examiners (ACFE).

The Episcopal Church Foundation (ECF) has received a three-year grant as part of Lilly Endowment’s National Initiative to Address the Economic Challenges Facing Pastoral Leaders. ECF’s grant entitled “From Economic Challenges to Transformational Opportunities” will provide lay and clergy leaders of the Episcopal Church with resources, tools and other support to help address the financial and leadership challenges of congregational ministry in the 21st century. This article was made possible by the Lilly Endowment grant. For more information on ECF’s Lilly Endowment Initiative go to www.ecf.org.

Resources

- Financial Management for Episcopal Parishes by James Jordan (Church Publishing, Revised Edition 2017)

- Year Round Stewardship: Talking About Money an ECF webinar led by Chris Harris, February 11, 2014

- Good Stewardship Addresses Hopes and Fears by Kate Ferris, Vestry Papers, May 2007

- Create a sound parish budget by Craig Bossi, Vestry Papers, July 2009